Income Protection

The life of your company, is a life worth insuring

Financial security for your people, through life’s unexpected challenges

Income Protection pays a part of the salary to an employee if they cannot work for an extended period due to illness or injury. The cover term and the percentage of the salary payable is setup when you start the plan. Payments continue until the employee recovers, reaches the end of the cover term, or in the unfortunate event of their passing.

Become a preferred employer: Shows you care about employee financial security and well-being, fostering loyalty, and attracting dedicated professionals.

Shift financial liability: Insurance payments to impacted employees prevent significant payouts from your company’s capital or business profits.

Strengthen your company: By providing financial security tools, you foster a positive work environment, preparing your workforce and business for sustainable growth.

Your plan, your way

Put simply, Income Protection pays a percentage of the salary as continued income if illness or injury prevents an employee from working for a prolonged period. Income is paid until recovery, death, or the end of the payment duration setup.

Coverage can include illness, accident, or both.

Maximum coverage is up to 70% of an employee’s salary.

Indexation option increases covered salary to match inflation and living expenses.

Continued partial payment if the employee returns to work in a reduced capacity.

A partial payment is made for disabilities between the minimum degree and 66.7%.

Choose from three annuity payment options:

- Until term age, or

- A fixed duration, or

- A fixed duration + a lump sum payment.

This is a summary of the Zurich International Group Life Solutions (ZIGRS) – Income Protection policy.

For complete details, please refer to the ZIGRS Policy Terms and Conditions. You can request a copy and a quote from us.

A case for disability benefits

1 in 5

employees in the region have claimed for disability, which means they were able to access their policy benefits while they were still alive.

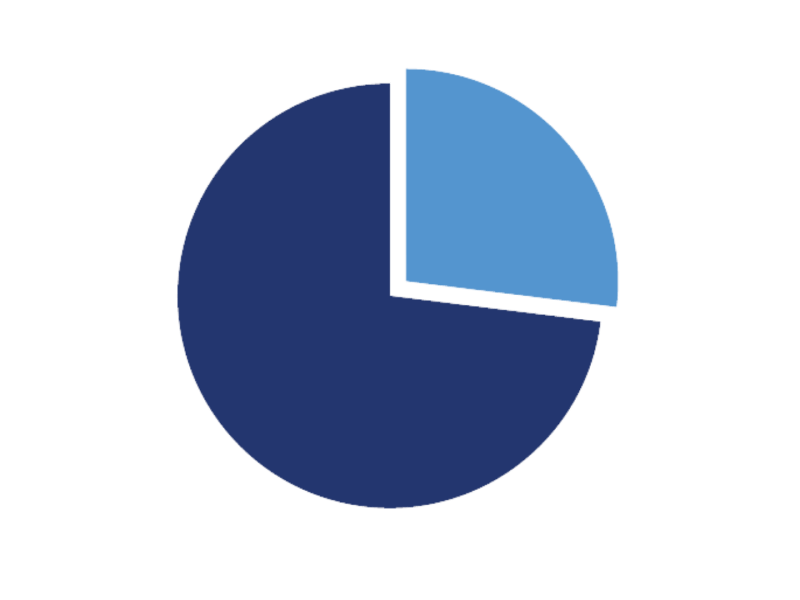

37%

of all disability claims paid over the last three years were Income Protection claims.

41

is the average age of employees who claimed for income protection.

One of the most important developments in employee well-being today is Income Protection. This disability benefit is a simple but powerful safety net — it helps by paying a portion of an employee’s salary when they’re facing a serious illness or can’t work for a long time.

What’s interesting in our data is that the average age of those claiming this benefit has dropped, from 51 to 41, which means employees are starting to see the importance of financial security earlier in their careers.

This trend also shows that more organisations are understanding how supporting employees through tough times helps create a stronger, more resilient team. Looking ahead, Income Protection will continue to be key in building more secure workplaces across the Middle East.

Rob Brown

Head of Corporate Life & Pensions Business,

Zurich International Life - Middle East

Income Protection – impacting lives

Francis’s resilience and financial security

1 June 2022 - Francis, 35, was urgently hospitalised due to a severe headache and sudden decrease in consciousness.

4 July 2022 - We received a claim notification. Medical assessments confirmed an unfortunate diagnosis of a malignant brain tumour.

1 June 2022 - 31 May 2023 Francis went on leave starting 1 June 2022, leading to a Temporary Total Disability (TTD) claim. After a 14-day waiting period, he received full benefits covering 100% of his salary, providing essential financial support during his recovery. Despite ongoing chemotherapy and hospital visits, his condition did not improve, and he continued to receive full salary under TTD cover.

1 June 2023 - 31 May 2025 Following the TTD benefits period, an Income Protection (IP) claim was admitted with a 12-month waiting period. We provided regular medical updates and advance quarterly payments, amounting to 60% of his salary. Monthly financial support at 60% of his salary continued until May 2025.

Ongoing Support Francis remains insured under Income Protection, and we continue to pay 60% of his salary until he can return to work or reaches term age. We wish him a speedy recovery.

(Name changed to maintain privacy.)

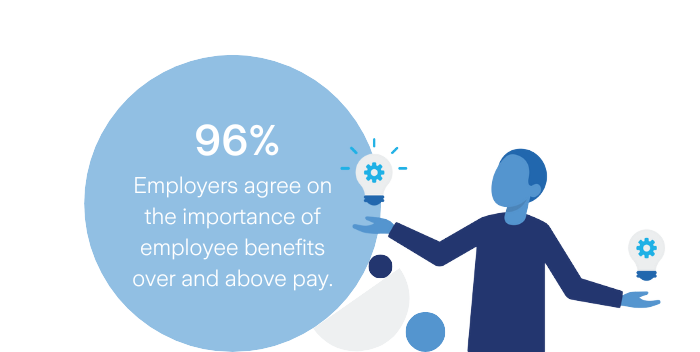

Employee benefits are becoming a key differentiator for attracting talent, apart from salary.

Source: Zurich Future of Work report 2024 – Read the full report

How do we get it?

Reach out to our employee benefits experts.