Group Protection

Critical Illness

Financial security for your people,

when they need it most

Critical Illness benefit is an important option available with our Group Protection solution. If an employee is diagnosed with a serious illness such as cancer, heart attack or stroke, they will receive a lump sum to help with living expenses and unexpected medical costs. This support enables your employees to focus on their treatment and recovery without the added worry of financial pressure, helping you provide meaningful care when it matters most.

Become a preferred employer: Show you care about your employees’ financial security and well-being. This fosters loyalty and helps attract top talent.

Shift financial liability: Insurance payments to impacted employees may help prevent payouts from your company’s capital or business profits.

Strengthen your company: By providing financial security tools, you foster a positive work environment, preparing your workforce and business for sustainable growth.

Coverage based on real claims experience

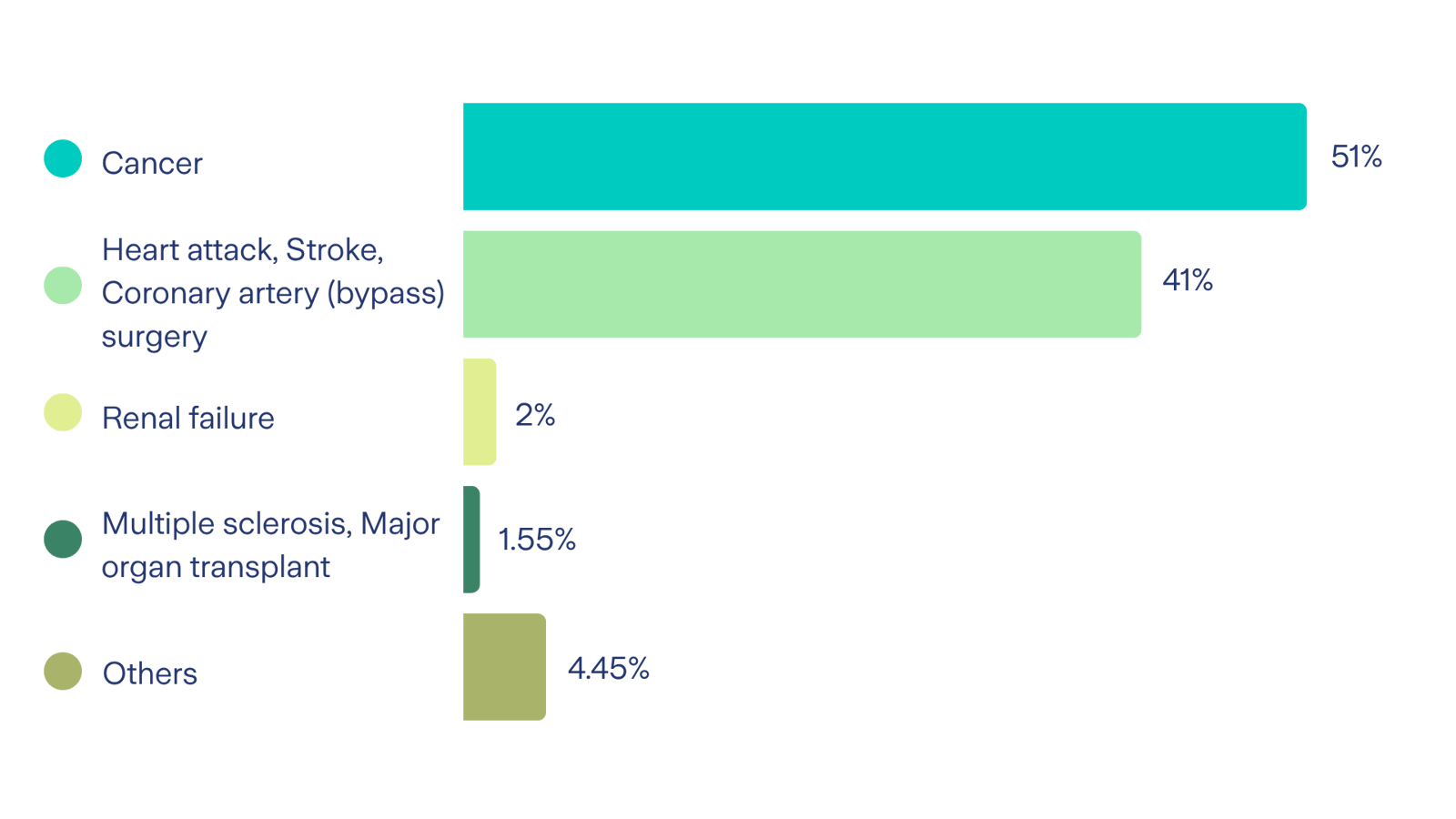

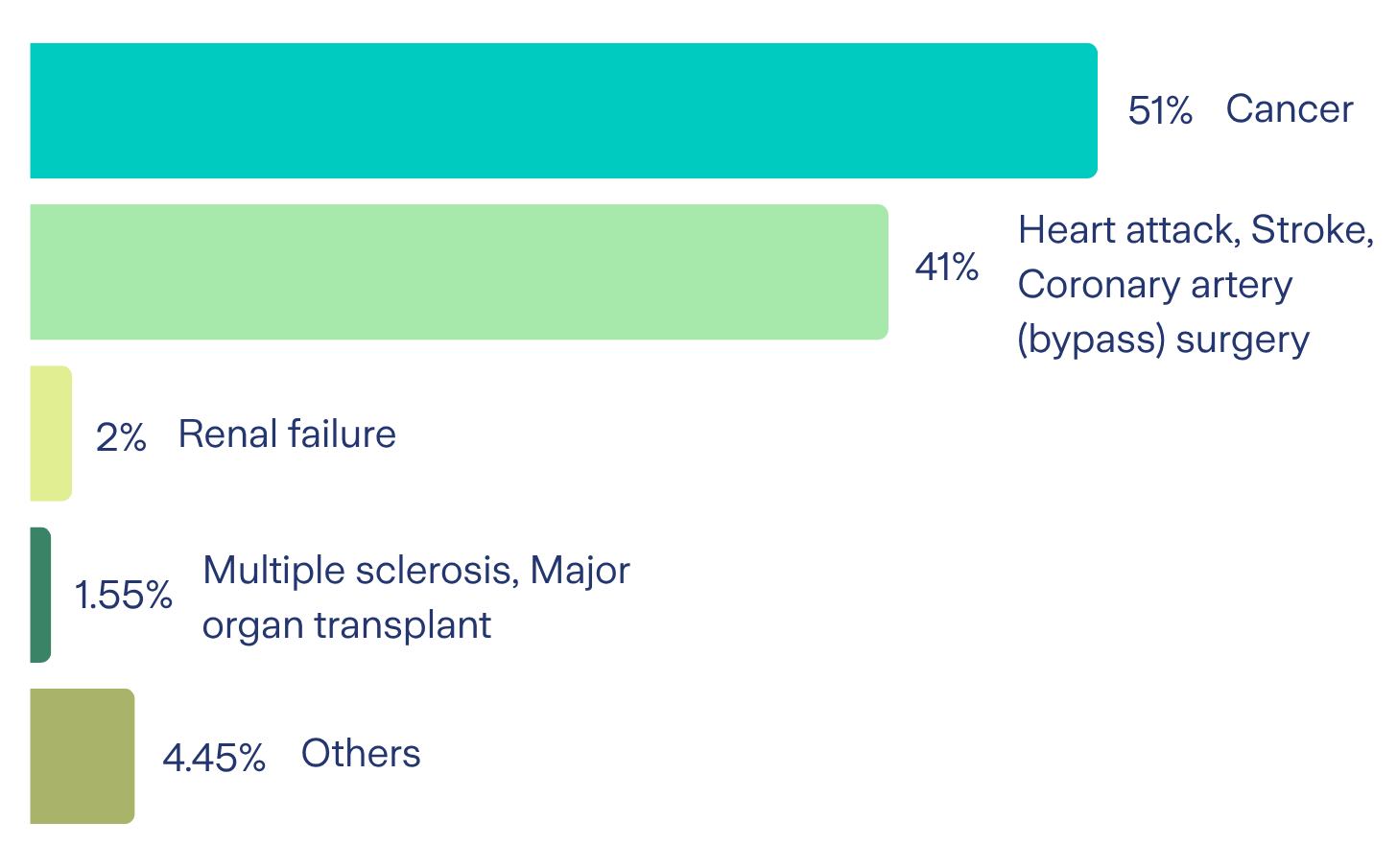

Our Critical Illness cover protects against the seven major causes of claims

- Cancer

- Heart attack

- Stroke

- Kidney (Renal) failure

- Coronary artery (bypass) surgery

- Major organ transplant

- Multiple sclerosis

These illnesses represent 96% of all claims, so protection is focused where it matters most.

Zurich data: Critical illness claims in the Middle East 2022 to 2024.

Zurich data: Critical illness claims in the Middle East 2022 to 2024. Zurich data: Critical illness claims in the Middle East 2022 to 2024.

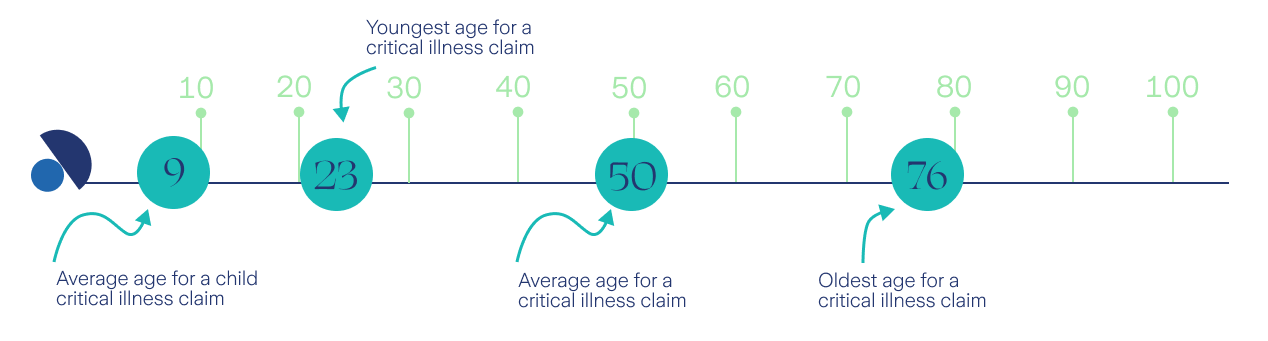

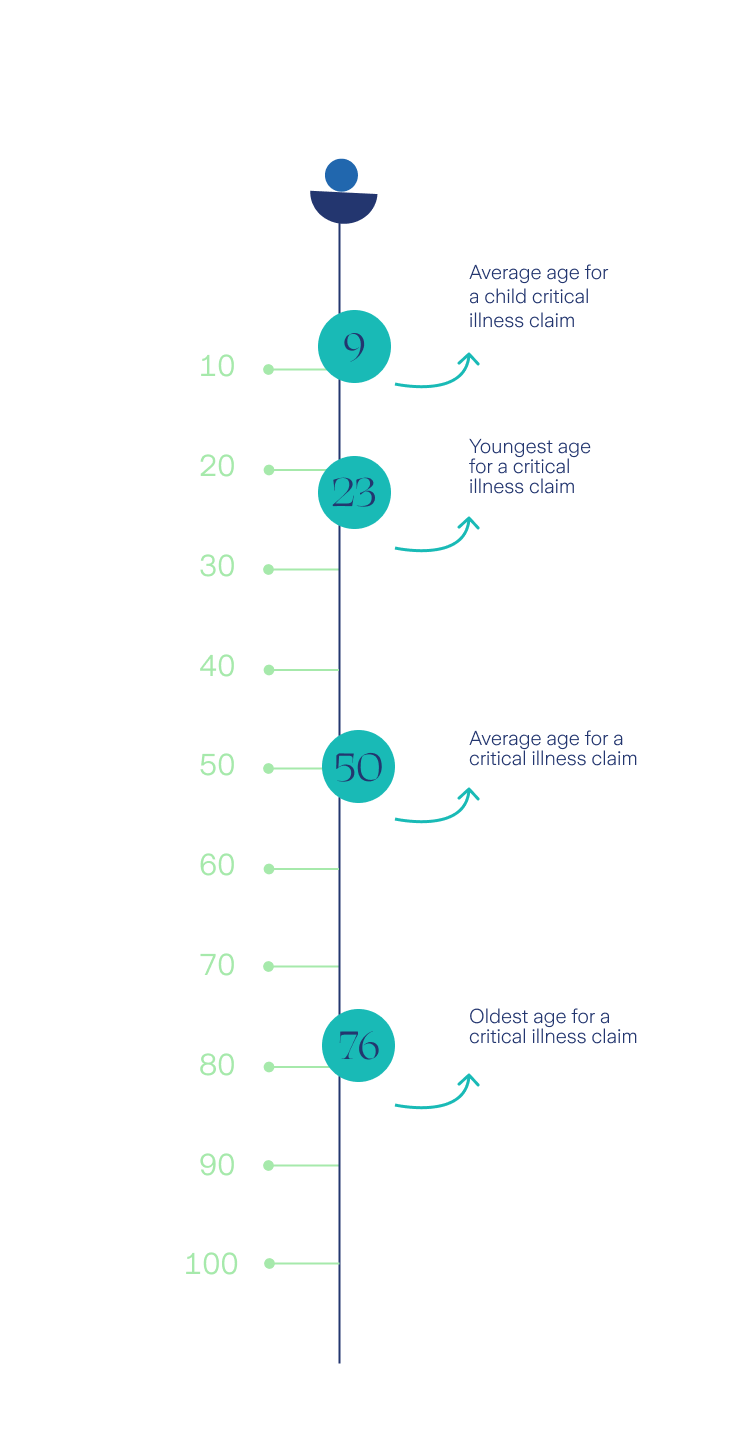

Zurich data: Critical illness claims in the Middle East 2022 to 2024.Every year, it’s happening sooner

Our claims experience shows that serious illnesses can impact younger people, underscoring the value of Critical Illness cover as part of your employee benefits package. A diagnosis can have a significant financial impact, often when it is least expected.

By offering critical illness benefit, you provide meaningful support that helps employees through life’s most challenging moments, giving them and their families greater financial security and peace of mind.

Zurich data: Critical illness claims in the Middle East between 2022 to 2024.

Zurich data: Critical illness claims in the Middle East between 2022 to 2024. Zurich data: Critical illness claims in the Middle East between 2022 to 2024.

Zurich data: Critical illness claims in the Middle East between 2022 to 2024.We deliver on our promise promptly

At Zurich, we understand that making a claim is a crucial moment for our customers. It’s our chance to support them and deliver on our promise during what is often a challenging time.

More details

How do we get it?

Reach out to our employee benefits experts.