Futura

If you pass away while your policy is active, we’ll pay out a cash lump sum. In addition, you have the option to add covers such as critical illness and permanent and total disability benefit that pay out on events that could arise during your lifetime.

Your premiums will be invested in funds of your choosing, and the value of the funds will be used to cover the cost of your insurance benefits.

With its wide range of options, Futura can be tailored to meet very specific cover requirements, both at the start of the plan, but also in a way that evolves with your needs over your lifetime.

What’s covered

What’s covered

Protection if you pass away

We’ll pay out a lump sum if you pass away during the policy term.

Protection if you become seriously ill

Futura offers a range of additional cover options, including critical illness cover which would pay out upon the diagnosis of diseases such as cancer, heart attack and stroke.

Cover for your lifetime or less

Set up your policy to be covered for the whole of your life or a specific time frame depending on your needs.

Premium payment flexibility

Pay your premiums over a time frame that suits you, whether that’s 7 or 50 years. For example, pay over 10 years to be covered for the rest of your life.

Choose which funds to invest in

You can invest your premiums in a wide range of funds. These funds will then be used to cover the cost of your insurance benefits.

For a full understanding of the products, please refer to the policy terms and conditions.

What’s not covered

What’s not covered

What’s not covered

Unfortunately, we can’t cover all circumstances, including:

Suicide and self-inflicted injuries

You won’t be covered if you die as a result of suicide or intentional, self-inflicted injury within the first year of the policy.

If you aren’t completely honest with us

As part of your application, we’ll ask you about your health and lifestyle. Your answers determine how much your plan will cost. If you're dishonest, we might not be able to pay your claim.

Withdrawal of the policy value

Cover will continue for as long as the fund value can continue to support its cost. Any funds taken out of the policy will have an impact on how long the cover lasts. If the policy value is reduced to zero, then cover will cease and the policy lapse.

Tailor your plan to suit your needs

![]()

Pay monthly or yearly, whatever suits you

![]()

Insure your partner at the same time

![]()

Get a Medical Second Opinion at no extra cost.

![]()

Choose your currency

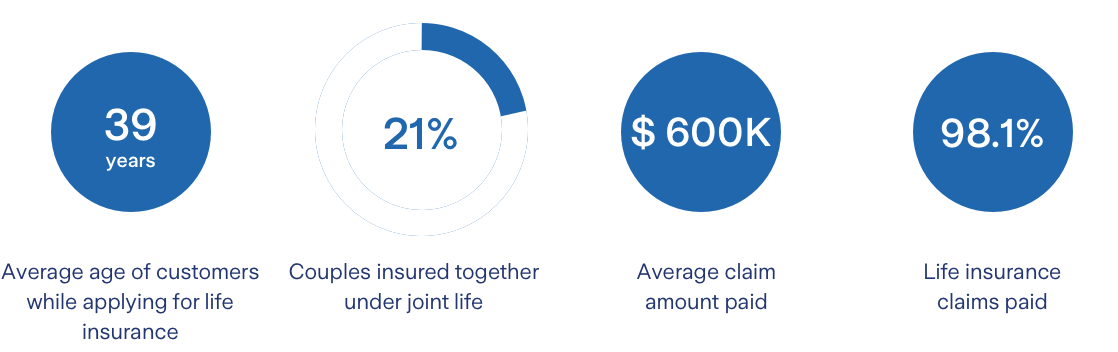

Everyone's different. We want to protect everyone.

Source: Based on Zurich internal data as of April 2024.