Critical Illness Protection

If you’re diagnosed with a serious illness like cancer, a heart attack or organ failure during the term of your policy, we’ll pay out a lump sum amount to you. This helps you to cover your living expenses so you can focus on your treatment and recovery.

What’s covered

What’s covered

Protection if you get seriously ill

We’ll pay out a lump sum if you’re diagnosed with a serious illness during the policy term.

Flexible length of cover

You can choose the length of cover you need - from 5 to 35 years.

- Comprehensive critical illness covers 34 illnesses including cancer, heart attack, organ failure and others which are listed in the product documents below.

- Cancer cover which covers 3 types of cancer.

- Child’s cancer or child’s critical illness cover of USD 15,000 per child - for up to 3 children aged between 1 to 18 years.

- Funeral coverage of USD 5,000 paid to the nominated beneficiary.

For a full understanding of the products, please refer to the policy terms and conditions.

What’s not covered

What’s not covered

Unfortunately, we can’t cover all circumstances, including:

Not paying your premiums

If your payments stop, so does your cover.

Illness outside the policy term

You choose how long your cover lasts. Once the term ends, your cover will stop which means we won’t pay if you're diagnosed with a serious illness.

Claims that don't qualify

Claims that meet the conditions and definitions included in the Policy Terms and Conditions will be paid. We apply discretion to pay claims in as many circumstances as possible however conditions that are specifically excluded in our product literature will not be paid.

If you aren’t completely honest with us

As part of your application, we’ll ask you about your health and lifestyle. Your answers determine how much your plan will cost. If you're dishonest, we might not be able to pay your claim.

Leave your contact details and a dedicated Zurich Adviser will call you back.

You can also contact us on

ZurichAdvisoryNetwork@zurich.com

800 ZURICH

Monday to Friday, 8am to 5pm

Tailor your plan to suit your needs

![]()

Pay monthly or yearly, whatever suits you

![]()

Insure your partner at the same time

![]()

Increase the amount insured during the policy term

![]()

Choose your preferred currency

Everyone's different. We want to protect everyone.

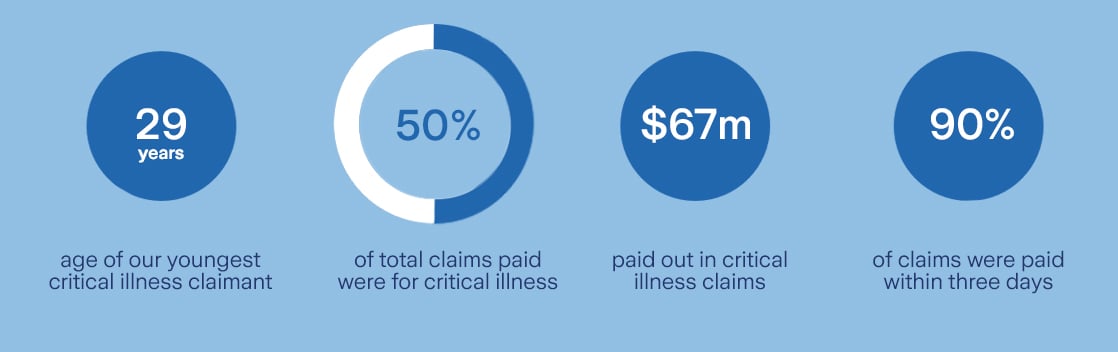

Source: Based on Zurich internal data as of April 2024.