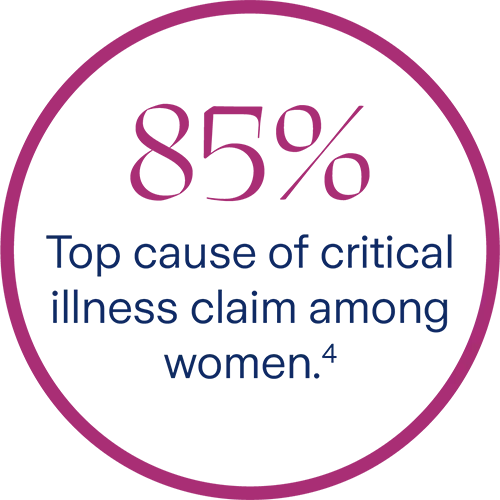

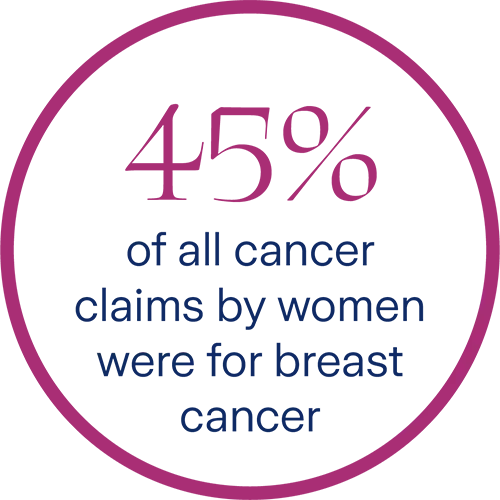

Know your risks  Critical illness claim

Critical illness claim

Source:

- 4. Zurich claim report 2023

Are you prepared for a challenge like cancer?

Getting a critical illness like cancer is not only emotionally and physically challenging but also financially draining. You need to be able to continue paying rent, manage household expenses or children’s care and school fees. You may also need to take unpaid sick leaves, or could even lose your job. In tackling such life’s uncertainties, you need to be financially prepared.

How could cancer affect you

Breast cancer is the most frequently diagnosed cancer among women in 140 of 184 countries worldwide, representing one in four of all cancers in women. Since 2008, diagnosis has increased by more than 20%, whilst mortality has increased by 14%.1

5x

UAE cancer rate in young adults than in the UK and USA.2

93%

women in the UAE worry about getting cancer.3

1 in 2

women wouldn’t be able to manage financially for more than 3 months if faced with a serious illness.3

56%

women think it takes between 3 months to 5 years to physically recover to be able to return to work.3

Source:

- 1. http://www.tradearabia.com/news/HEAL_346344.html

- 2. The National - UAE National Cancer Registry 2021

- 3. Critical Illness Survey Report commissioned by Zurich International Life and YouGov

Get familiar with the costs of treatment

Chemotherapy

AED 25K-40K

Average cost in Dubai

for one treatment.5

for one treatment.5

(Can go up to AED 55,000 in some cases. Most women need 5 to 8 cycles of chemotherapy)

Radiotherapy

AED 120K

Average cost in

Dubai for one

session.5

Dubai for one

session.5

(Expensive than chemotherapy)

Reconstructive surgery

AED 80K

Approximate cost of unilateral surgery.6

AED 120K

Approximate cost of bilateral surgery.6

Source:

- 5. http://www.tradearabia.com/news/HEAL_346344.html

- 6. Zulekha Hospital, UAE

Recovery time after surgery*

Lumpectomy

5–10 days

to get back to day-to-day activities.7

Mastectomy

3–4 weeks

after surgery to get back to normalcy.7

Mastectomy

(with reconstruction)

(with reconstruction)

6–8 weeks

to recover. This procedure has the longest recovery time.7

*Excluding any concurrent chemotherapy or radiotherapy.

Source:

- 7. https://www.medicalnewstoday.com/articles/breast-cancer-surgery#recovery-time

How can we help

As part of our commitment to have you ready for such unforeseen challenges, we are offering a cancer-only cover that is low-cost and can also be taken by applicants with underlying medical conditions or medical histories.

It also includes lump sum payment options for various types of cancer.

Cost effective

Cancer-only cover is lower cost than a comprehensive critical illness benefit and covers the most prevalent and concerning condition for women in particular.

Come as you are

Cancer-only cover can also be taken by applicants with underlying medical conditions or medical histories.

Benign brain tumour

resulting in permanent symptoms.

Cancer

excluding less advanced cases.

Ductal carcinoma in situ of the breast*

with specific treatment. (partial payment lower of 12.5% sum assured or USD 20K, deducted from the sum insured).

* This is an early-stage cancerous condition in the milk ducts that has not spread. At Zurich, we offer a part payment of the benefit to enable customers to get the treatment

they need before the condition progresses to something more serious, rather than reject claims under this condition because it does not meet a typical cancer definition.

* This is an early-stage cancerous condition in the milk ducts that has not spread. At Zurich, we offer a part payment of the benefit to enable customers to get the treatment

they need before the condition progresses to something more serious, rather than reject claims under this condition because it does not meet a typical cancer definition.

Many people think that because they have medical insurance via their employment, they are covered when it comes to critical illnesses like cancer, which isn’t always true.

Many additional costs that you may incur due to your critical illness, may not come under your medical cover.

Medical insurance compensates the facilities that provide medical services, like your hospitals or clinics.

Medical insurance could be limited to treatment costs and has annual limits, co-pay, exclusions and conditions.

In a critical illness like cancer, a lump sum payment is needed to provide financial security without worrying about depleting savings or creating debt.

Companies normally provide paid leave for 15 working days a year. The time one needs off work during a critical illness is much more than that.

Start the conversation today.