Our 2022 Customer Benefits Paid Report offers insights on the health risks prevalent in the Middle East, helping you plan and prepare to be better protected. Having paid customer claims amounting to USD 144 million, we made sure 98% of all life claims were paid out. Ensuring that most of these were paid out within 72 hours is a testament to our promise to be there for you when you need us the most.

COVID-19 is the second highest cause of life claims.

52% of the total customer benefits paid out were life cover claims.

Heart attack and stroke

are one of the major causes for life and critical illness claims.

are one of the major causes for life and critical illness claims.

Living and life cover benefit claims compared

This year is different

You’ve come a long way You’ve fought hard You’ve faced financial difficulty You’ve lost people you loved But you’ve been brave You’ve come out of this stronger You believe that beyond uncertainty there is hope When you imagine the future, you see it brighter than today This year is different because… You’re better prepared.

48% Cancer

48% Cancer 43% Heart attack & stroke

43% Heart attack & stroke 7% Others*

7% Others* 2% Renal failure

2% Renal failure

*Zurich offers free children’s critical illness cover for up to three children when you take a critical illness benefit on a whole of life policy or a critical illness protection plan. Cover is only up to USD 15K.

| Type of benefit | Average | Youngest |

|---|---|---|

| 43 | 27 | |

| 52 | 47 |

Causes of critical illness claim by gender

84% Cancer

84% Cancer 7% Heart attack & stroke

7% Heart attack & stroke 6% Others*

6% Others* 3% Renal failure

3% Renal failure

*Motor Neurone disease, Multiple Sclerosis, Parkinson's, Coma, Organ Failure, Benign Brain Tumor

62% Heart attack & stroke

62% Heart attack & stroke 29% Cancer

29% Cancer 7% Others*

7% Others* 2% Renal failure

2% Renal failure

*Motor Neurone disease, Multiple Sclerosis, Parkinson's, Coma, Organ Failure, Benign Brain Tumor

Critical illness claims

35% Heart attack & stroke

35% Heart attack & stroke 24% COVID-19

24% COVID-19 21% Cancer

21% Cancer 14% Other**

14% Other** 6% Accidents

6% Accidents

| Type of benefit | Average | Youngest |

|---|---|---|

| 42 | 42 |

Causes of life cover claim by gender

41% Cancer

41% Cancer 17% Heart attack & stroke

17% Heart attack & stroke 17% COVID-19

17% COVID-19 21% Others**

21% Others** 4% Accidents

4% Accidents

**Pneumonia, Pancreatitis, Organ Failure, Unspecified Natural causes

41% Heart attack & stroke

41% Heart attack & stroke 25% COVID-19

25% COVID-19 15% Cancer

15% Cancer 12% Others**

12% Others** 7% Accidents

7% Accidents

**Pneumonia, Pancreatitis, Organ Failure, Unspecified Natural causes

Life cover claims

Come as you are and not how we want you to be

97%

of all life insurance applications we received were accepted by us.

Your health is in your hands. Simple action can make the difference.

Top 5 pre-existing condition applications accepted

What makes us proud

Over the past three years, we have paid out over USD 144 million in benefits to our customers in the Middle East. Our solid financial ratings combined with strong market and industry recognition mean you can rest assured that we will deliver on our promise to you.

Total benefits paid

95%

of all critical illness claims were paid over last 3 years

98%

of all life claims paid over last 3 years

Why we didn’t pay the remaining percentage

Unpaid benefits were due to non-disclosure or fraud. Be transparent about your health, lifestyle, and family history when buying life insurance.

*on receipt of all satisfactory documents.

Largest benefits paid

USD 1 million critical illness cover

USD 5.93 million life cover

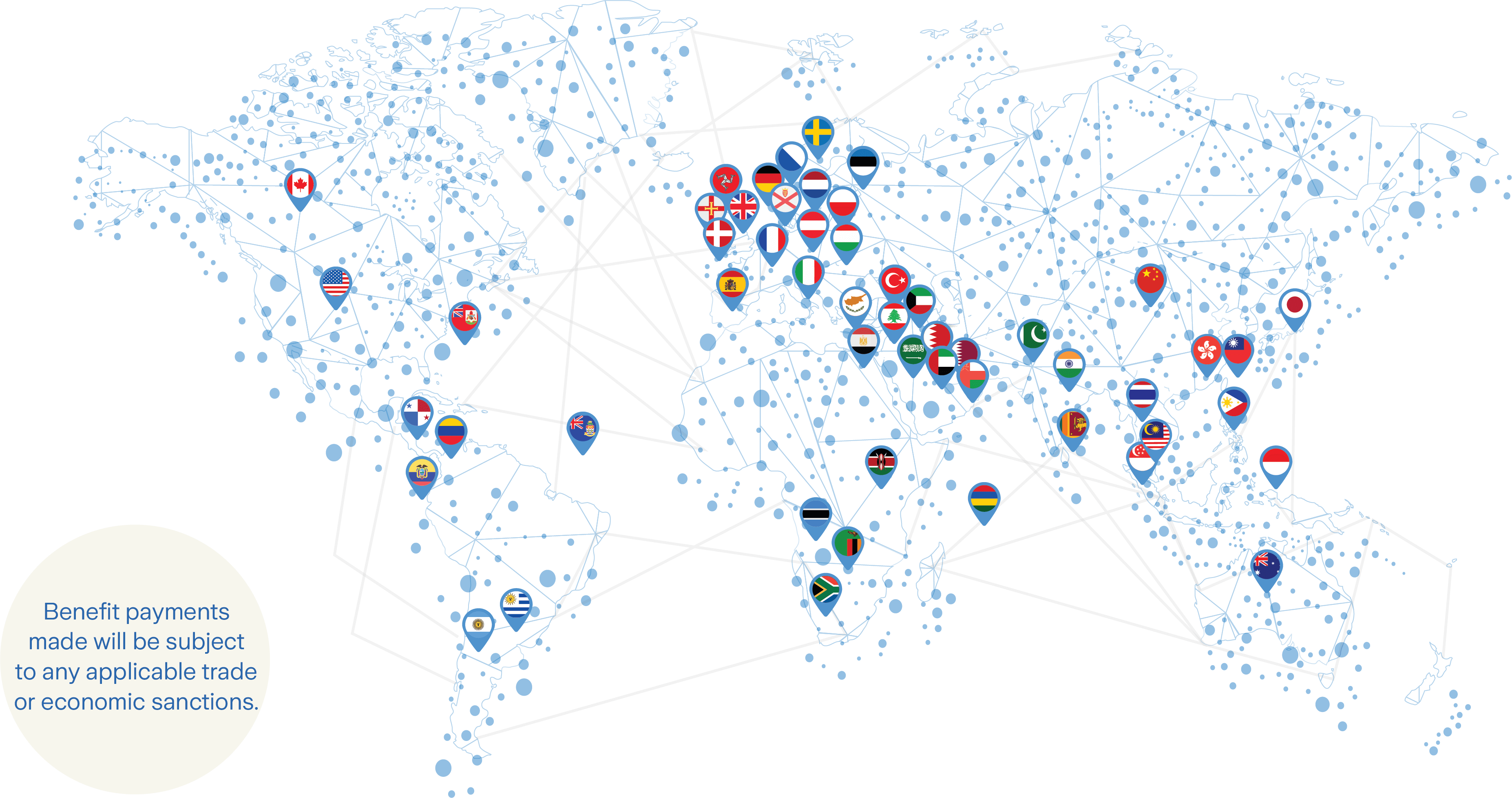

Currency and payout countries available

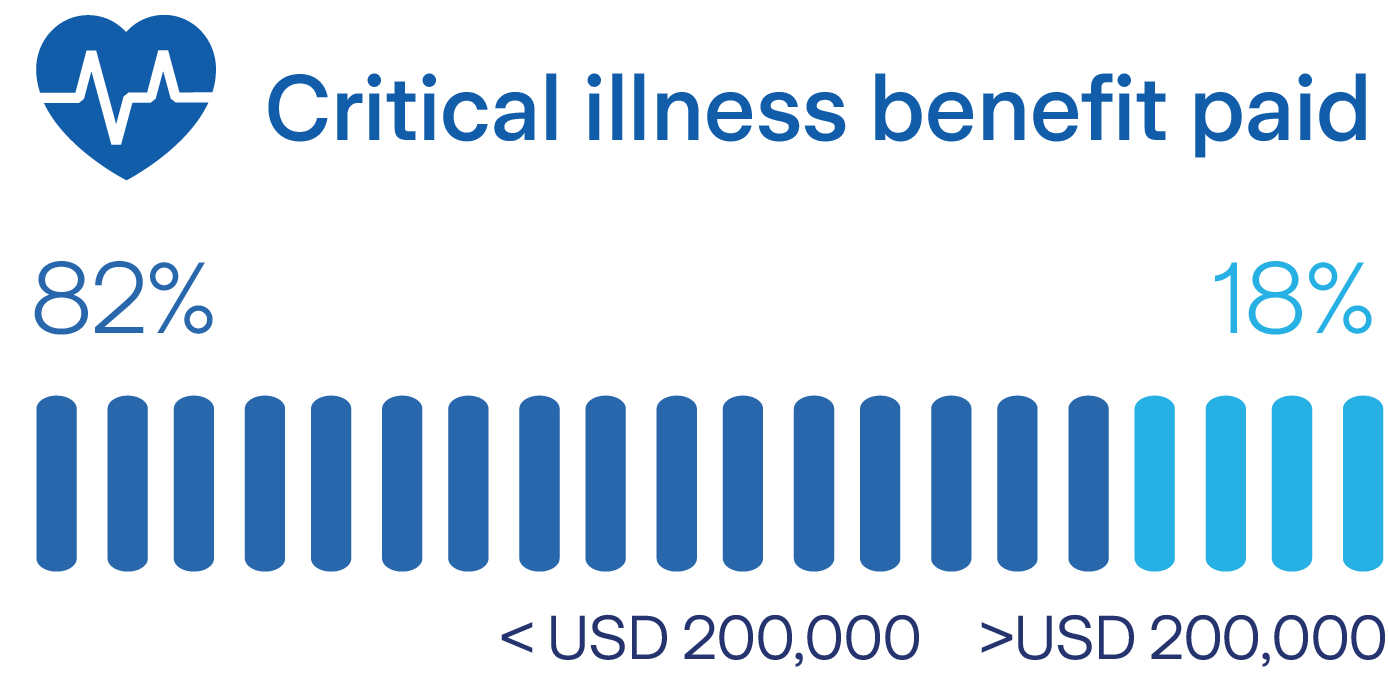

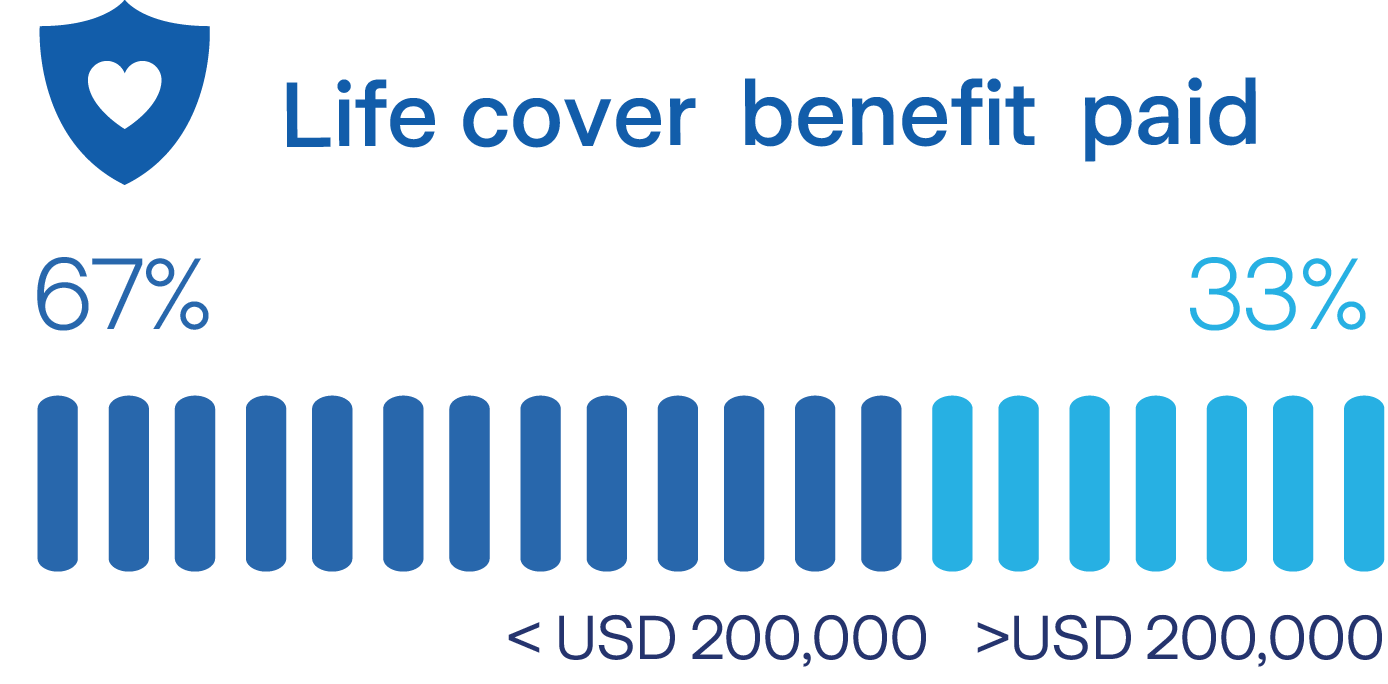

In most cases, our customers who have claimed had less than USD 200,000 of coverage. Ensure you have enough protection to cover your future financial needs.

Why we do what we do

Start the conversation today.